After a Disaster, Here’s Where Taxpayers Can Find IRS Information Fast

After a Disaster, Here’s Where Taxpayers Can Find IRS Information Fast Rebuilding after a natural disaster can be overwhelming. Important documents like financial information and tax records [...]

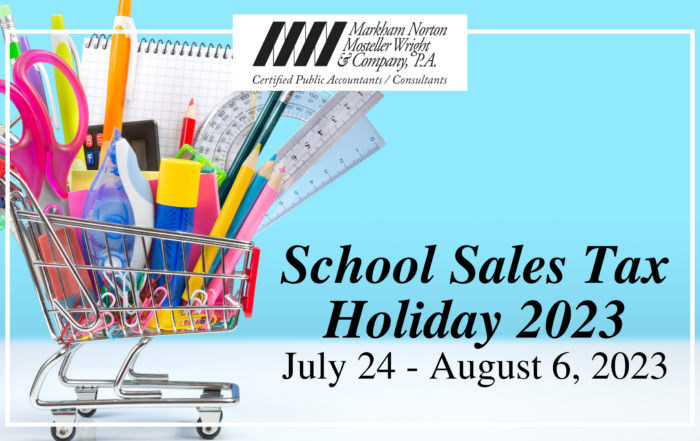

School Sales Tax Holiday 2023

School Sales Tax Holiday 2023 The 2023 Back-To-School Sales Tax Holiday is right around the corner. Every year various states offer sales tax holidays and/or tax-free weekends [...]

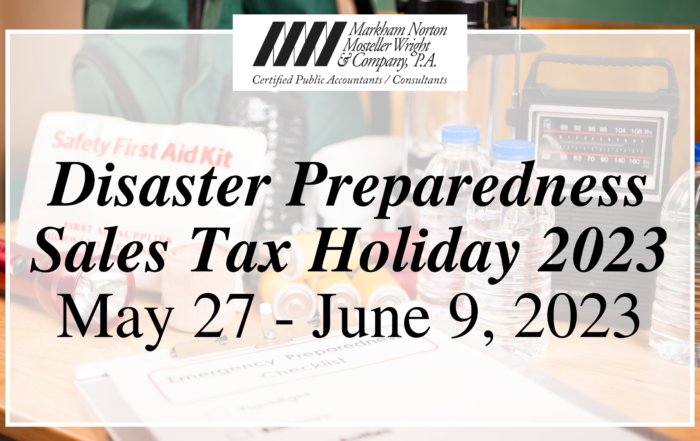

Disaster Preparedness Sales Tax Holiday 2023

Disaster Preparedness Sales Tax Holiday 2023 Annually several states offer sales tax holidays and/or tax-free dates to help reduce the cost burden for their residents. The Florida [...]

Hobby or Business: Here’s What To Know About That Side Hustle

Hobby or Business: Here’s What To Know About That Side Hustle Sometimes the line between having a [...]

Rep. Byron Donalds & Sen. Rick Scott Lead Letter To President Biden In Support Of Hurricane Tax Relief Act

Due to the impacts from the 2022 Hurricane Season on so many Floridians, we decided to share [...]

Taxpayers and Tax Pros Should Learn about These Common Tax Scams

Taxpayers and Tax Pros Should Learn About These Common Tax Scams While scammers work hard during tax [...]

When an IRS Letter Arrives, Taxpayers Don’t Need to Panic, but They Do Need to Read It

When an IRS Letter Arrives, Taxpayers Don’t Need to Panic, but They Do Need to Read It [...]

Here’s What Taxpayers Need to Know to Claim Clean Vehicle Tax Credits

Here’s What Taxpayers Need to Know to Claim Clean Vehicle Tax Credits The Inflation Reduction Act of [...]

Taxpayers Can Avoid Processing Delays and Refund Adjustments Following These Tips

Taxpayers Can Avoid Processing Delays and Refund Adjustments Following These Tips Taxpayers can avoid common errors on [...]

Important Tax Reminders For People Selling A Home

Important Tax Reminders For People Selling A Home A lot of families move during the summer. Taxpayers who are selling their home may qualify to exclude all or part of any gain from the sale [...]

2022 Sales Tax Holidays and Exemption Periods for the State of Florida

2022 Sales Tax Holidays and Exemption Periods for the State of Florida Every year various states offer sales tax holidays and/or tax-free dates to help reduce the cost burden for its residents. The Florida Department [...]

MNMW Hosted Another Record-Breaking Shred Day

MNMW Hosted Another Record-Breaking Shred Day MNMW hosted another record-breaking fundraiser with its annual Community Shred Day to benefit the United Way of Lee, Hendry, and Glades Counties. The firm partnered with Secure Shredding, Inc. [...]

IRS Tax Withholding Estimator Helps Taxpayers Get Their Federal Withholding Right

IRS Tax Withholding Estimator Helps Taxpayers Get Their Federal Withholding Right All taxpayers should review their federal withholding each year to make sure they're not having too little or too much tax withheld. Doing this [...]

Corporate Social Responsibility

Corporate Social Responsibility - What's All The Buzz About! Corporate social responsibility can be best explained as a company aligning its values with the greater benefit of our society. Meaning it engages in various contributions [...]

Taxpayers Should Open And Carefully Read Any Mail From The IRS

Taxpayers Should Open And Carefully Read Any Mail From The IRS The IRS mails letters or notices to taxpayers for a variety of reasons including: • They have a balance due. • They are due [...]

Our firm provides the information on our blog/vlog for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been provided with all pertinent facts relevant to your particular situation. Tax articles on this website are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.