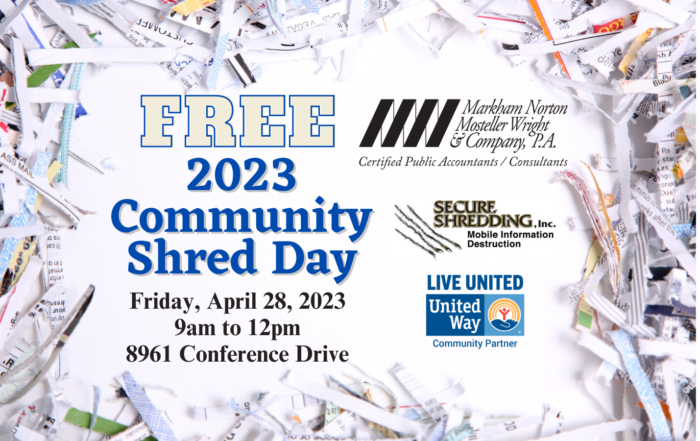

MNMW Hosting Annual FREE Shred Day Event to Benefit United Way

MNMW Hosting Annual FREE Shred Day Event to Benefit United Way Markham Norton Mosteller Wright & Co., P.A. (MNMW) will partner with Secure Shredding, Inc. to host [...]

Options for Taxpayers with a Tax Bill They Can’t Pay

Options for Taxpayers with a Tax Bill They Can’t Pay Taxpayers who can't pay their tax bill by the April 18, 2023, deadline shouldn't panic. The IRS [...]

Taxpayers Should Know That an Extension to File Is Not an Extension to Pay Taxes

Taxpayers Should Know That an Extension to File Is Not an Extension to Pay Taxes Taxpayers who aren't able to file by the April 18, 2023, deadline [...]

People May Want to File a Tax Return – Even if They Aren’t Required to Do So

People May Want to File a Tax Return – Even if They Aren’t Required to Do So [...]

MNMW Welcomes Two New Team Members

MNMW Welcomes Two New Team Members Markham Norton Mosteller Wright & Company, P.A. (MNMW), recently welcomed two [...]

The EITC Is A Major Tax Benefit For Millions Of Low And Moderate Income Workers

The EITC Is A Major Tax Benefit For Millions Of Low And Moderate Income Workers The EITC [...]

Understanding Business Travel Deductions

Understanding Business Travel Deductions Whether someone travels for work once a year or once a month, figuring [...]

The Benefits Of Having A Tax Refund Direct Deposited

The Benefits Of Having A Tax Refund Direct Deposited Receiving a tax refund is happy news to [...]

Tax Tips For Gig Economy Entrepreneurs And Workers

Tax Tips For Gig Economy Entrepreneurs And Workers In recent years, the gig economy has changed how [...]

It’s Important For Taxpayers To Know The Difference Between Standard And Itemized Deductions

It’s Important For Taxpayers To Know The Difference Between Standard And Itemized Deductions Taxpayers have two options when completing a tax return, take the standard deduction or itemize their deductions. Most taxpayers use the option [...]

MNMW Team Member Earns Certified Fraud Examiner Credential

MNMW Team Member Earns Certified Fraud Examiner Credential MNMW is pleased to announce that Courtney Crowley, CPA has earned her Certified Fraud Examiner (CFE) credential from the Association of Certified Fraud Examiners (ACFE). Individuals with [...]

IRS Releases Update To Watch For Advance Child Tax Credit Letter

IRS Releases Update To Watch For Advance Child Tax Credit Letter IR-2021-255, December 22, 2021 WASHINGTON — The Internal Revenue Service announced today that it will issue information letters to Advance Child Tax Credit recipients [...]

2022 Standard Mileage Rate is 58.5¢ Per Mile

2022 Standard Mileage Rate is 58.5¢ Per Mile The IRS has issued the new standard mileage rate that will take effect on January 1, 2022. The new rate is 58.5¢ per mile for the use [...]

Tax Filing Step 1: Gather All Year-End Income Documents

Tax Filing Step 1: Gather All Year-End Income Documents As taxpayers are getting ready to file their taxes, the first thing they should do is gather their records. To avoid processing delays that may slow [...]

MNMW Welcomes Kristine Tacca and Mark Oefinger to the Team

MNMW Welcomes Kristine Tacca and Mark Oefinger to the Team Recently, MNMW welcomed two new Senior Associates to the Tax and Accounting division. - “As the needs of our clients grow, along with the ever-changing [...]

Our firm provides the information on our blog/vlog for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been provided with all pertinent facts relevant to your particular situation. Tax articles on this website are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.