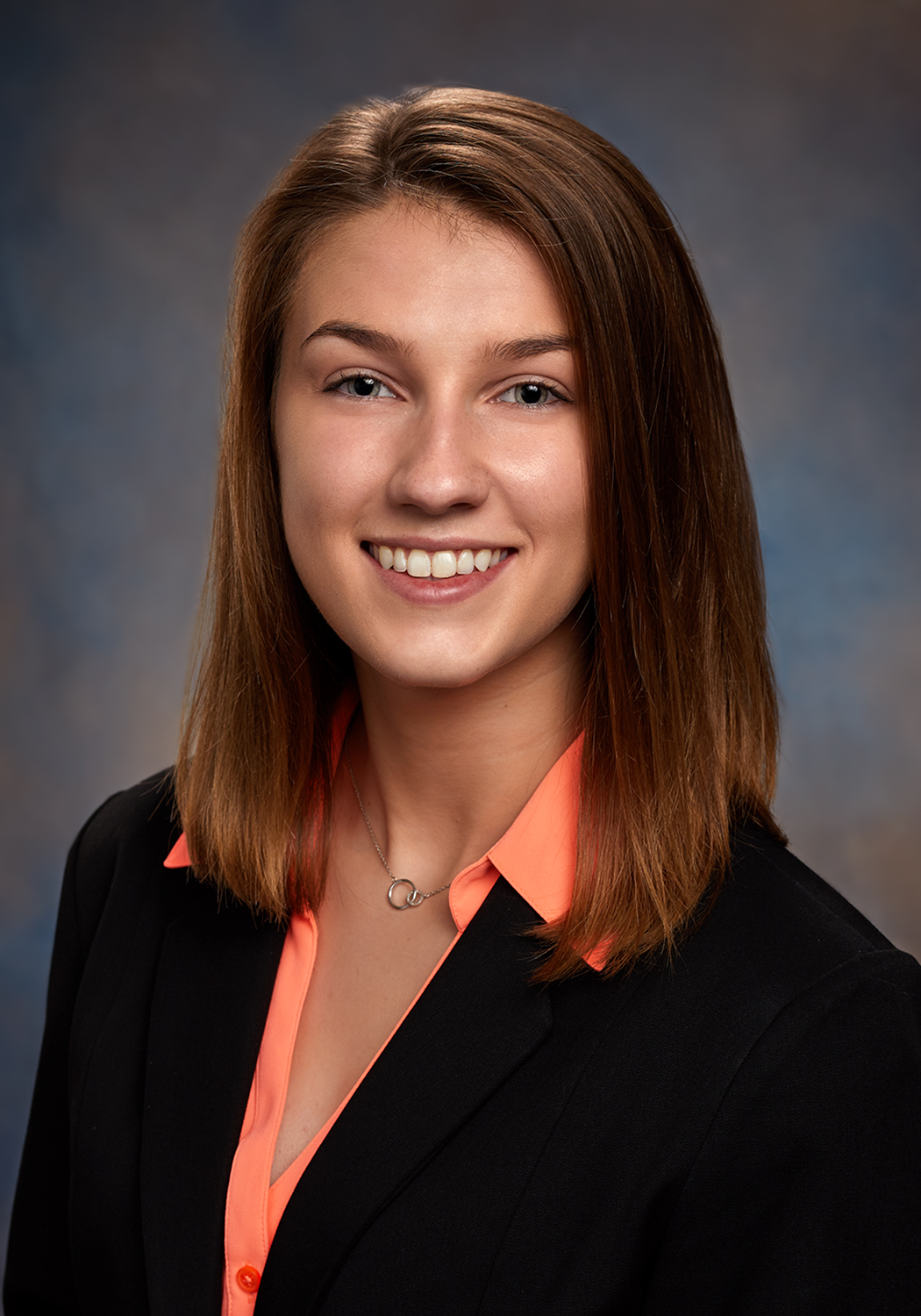

MNMW Welcomes Erica Pacetti to the Team

MNMW Welcomes Erica Pacetti to the Team Erica Pacetti recently joined Markham Norton Mosteller Wright & Company, P.A. (MNMW) as an Associate of the firm, providing litigation [...]

IRS Reminds Taxpayers An Extension To File Is Not An Extension To Pay Taxes

IRS Reminds Taxpayers An Extension To File Is Not An Extension To Pay Taxes For most individual taxpayers the tax filing and payment deadline is Monday, April [...]

What Taxpayers Should Do If They Have Incorrect Or Missing Documents

What Taxpayers Should Do If They Have Incorrect Or Missing Documents Taxpayers should make sure they have all their documents before filing a tax return. Taxpayers who [...]

Small Business Rent Expenses May Be Tax Deductible

Small Business Rent Expenses May Be Tax Deductible Rent is any amount paid for the use of [...]

MNMW Welcomes Tonya Waters to the Team

MNMW Welcomes Tonya Waters to the Team Tonya Waters recently joined Markham Norton Mosteller Wright & Company., [...]

The Provider Relief Fund Reporting for Period 2 Ends March 31, 2022

The Provider Relief Fund Reporting for Period 2 Ends March 31, 2022 The HHS opened the portal [...]

MNMW Hosting Annual FREE Shred Day

MNMW Hosting Annual FREE Shred Day Event to Benefit United Way Markham Norton Mosteller Wright & Co., [...]

Taxpayers Must Report Tip Money As Income On Their Tax Return

Taxpayers Must Report Tip Money As Income On Their Tax Return For those working in the service [...]

Gail Markham Receives ERC Award

Gail Markham Receives ERC Award Gail Markham, CPA, ABV, CFF, CFE, CFP®, Florida Supreme Court Certified Family [...]

Good Recordkeeping Is Just Good Business

Good Recordkeeping Is Just Good Business Good recordkeeping is an important part of running a small business. In fact, keeping good records helps business owners make sure their business stays successful. Here are some things [...]

MNMW’s Speakers’ Bureau

In addition to traditional tax and accounting services, we are trusted advisers and business consultants specializing in: construction business; medical and dental practices; human resources; information technology; non-profits; and marketing and public relations. Other specialty [...]

Lookout For New Version of SSN Scam

Taxpayers should be on the lookout for new version of SSN scam Taxpayers should be on the lookout for new variations of tax-related scams. In the latest twist on a scam related to Social Security [...]

Lindsey Earns Certified Fraud Examiner Credential

MNMW Team Member Earns Certified Fraud Examiner Credential Morgan Lindsey with Markham Norton Mosteller Wright & Co., P.A. (MNMW) recently earned the Certified Fraud Examiner (CFE) credential from the Association of Certified Fraud Examiners (ACFE). [...]

Records After A Disaster

Taxpayers can follow these steps after a disaster to reconstruct records After a natural disaster, taxpayers may need records to help them prove their disaster-related losses. This may be for tax purposes, getting federal assistance [...]

Compare Eligibility & Benefits of Two Education Credits

Taxpayers can compare eligibility and benefits of two education credits There are two education credits that can help taxpayers with higher education costs: the American opportunity tax credit and the lifetime learning credit. There are [...]

Our firm provides the information on our blog/vlog for general guidance only, and does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been provided with all pertinent facts relevant to your particular situation. Tax articles on this website are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed on the taxpayer. The information is provided “as is,” with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to warranties of performance, merchantability, and fitness for a particular purpose.